Debt payoff calculator for the real world

The only debt payoff app that handles payment plans, promotional rates, and multiple APRs on the same card—because your debt isn't simple, and your app shouldn't be either.

Your debt isn't simple. Why is your calculator?

Most debt apps ask for one balance, one APR. But your debt looks like this:

- A credit card with three different APRs on the same account

- Amazon financing with flat monthly fees, not interest

- A 0% promotional rate expiring in 8 months—with deferred interest

- Store payment plans with monthly fees

Enter these into typical apps and you get wrong payoff dates, wrong interest calculations, and strategies that cost you money.

PayClear was built for modern, complex debt

Finally, a calculator that matches how debt actually works—not how apps wish it worked.

- Track multiple APR portions on the same card

- Handle fee-based plans correctly (not as interest)

- Get deadline alerts before promotional rates expire

- See accurate payoff dates based on real math

Built for debt that doesn't fit in a box

Every feature designed for the complexity of real-world debt—not the oversimplified version other apps expect.

Four Debt Types

Interest-based, fee-based, installment, and promotional—because each type requires different math.

Multiple APRs Per Card

Track purchase, balance transfer, and cash advance portions separately. Payments allocated per Credit CARD Act rules.

Avalanche Strategy

Mathematically optimal payoff order. Target highest APR first, minimize total interest, finish faster.

Waterfall Payments

When a debt pays off, freed payments cascade to accelerate the next. Watch your payoff snowball.

What-If Scenarios

Model +$100, +$250, or a tax refund before committing. See exactly how extra payments change your timeline.

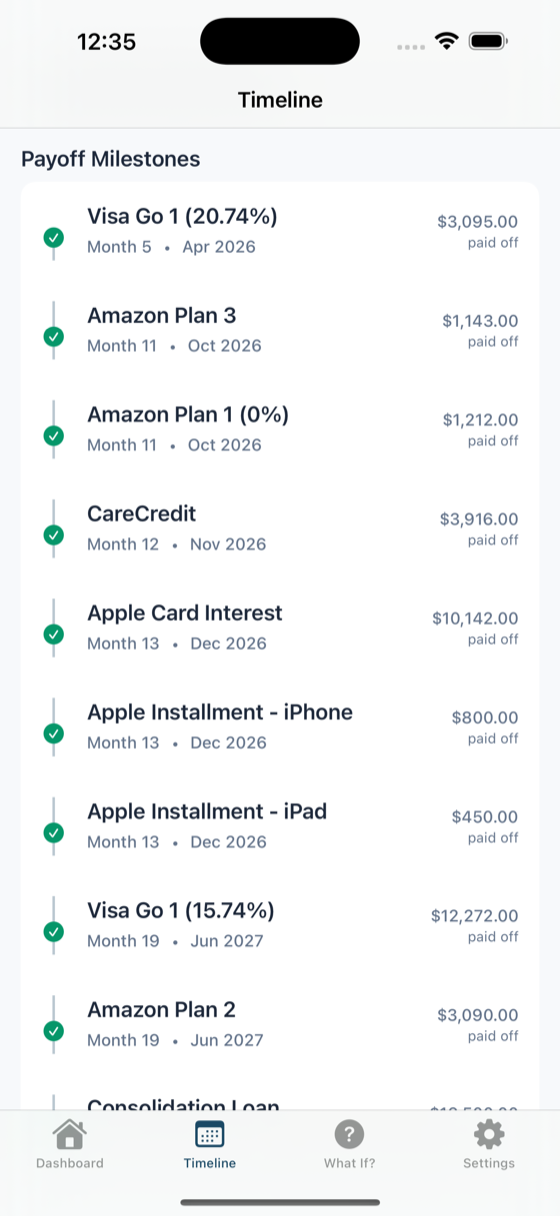

Timeline Visualization

Stacked area chart showing debt decline. Milestone markers when debts pay off. Clear debt-free date.

From chaos to clarity in four steps

No bank connections. No importing data. Just tell PayClear about your debts and it handles the math.

Add your debts

Enter each debt with its type—interest-based, fee-based, installment, or promotional. Multiple APRs on one card? Add each portion separately. PayClear handles the complexity.

- Four debt types for accurate calculations

- Track multiple APRs on the same card

- Set promotional rate deadlines

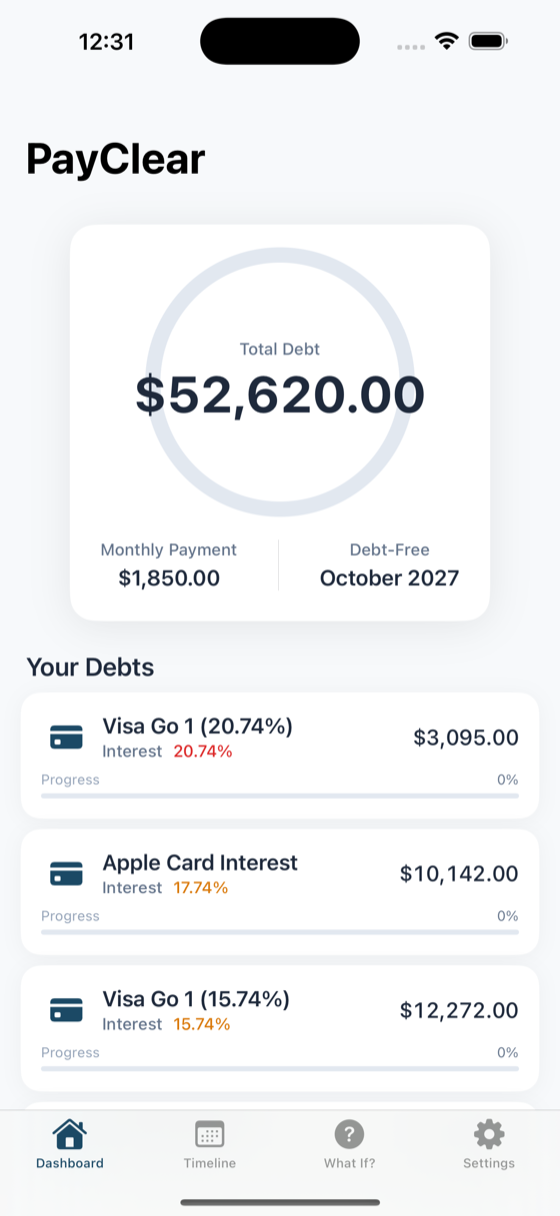

See your complete picture

Your dashboard shows total debt, monthly payment, and your debt-free date at a glance. Watch your progress with each payment you make.

- Total debt and debt-free date

- All debts with APR rates visible

- Progress tracking per debt

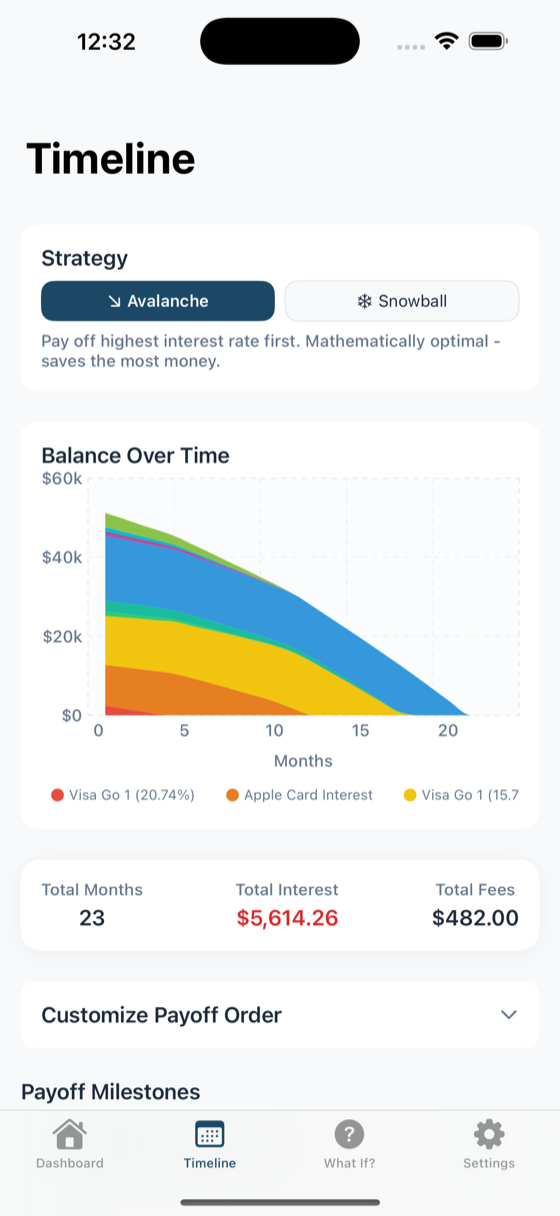

Follow the optimized plan

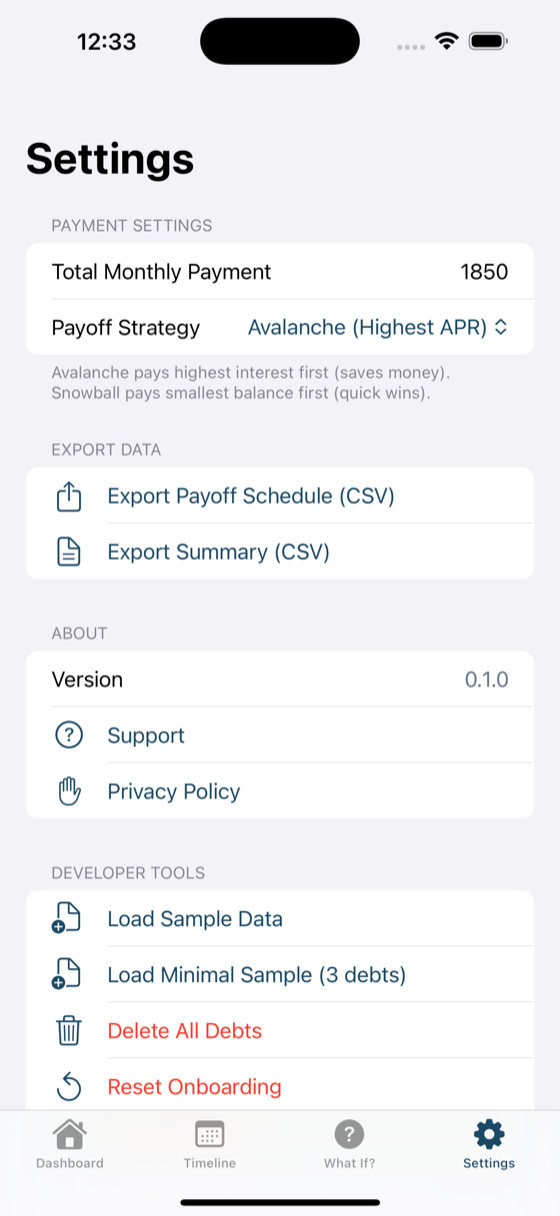

The timeline shows exactly how your debt shrinks over time. Choose between Avalanche (save most money) or Snowball (quick wins) strategies.

- Stacked area chart visualization

- Avalanche vs Snowball comparison

- Milestone markers when debts pay off

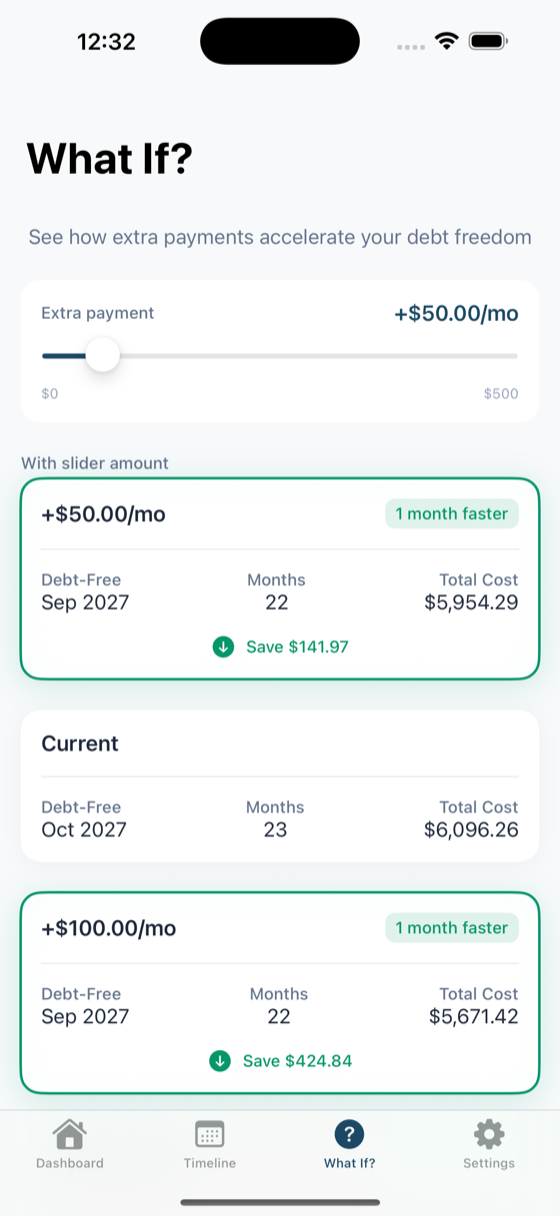

Explore what-if scenarios

Got a bonus? Tax refund? Slide to see exactly how extra payments accelerate your debt-free date and how much you'll save in interest.

- Interactive payment slider

- Instant savings calculations

- Compare multiple scenarios

More features

Simple, honest pricing

You're trying to get out of debt, not add another monthly payment. That's why PayClear is a one-time purchase—not a subscription.

Free

Perfect for getting started. All features, just limited debts.

- Up to 3 debts

- All 4 debt types

- Multiple APR portions

- Avalanche + waterfall

- What-if scenarios

- Timeline visualization

Pro

Unlimited debts, forever. One purchase, own it for life.

- Unlimited debts

- All 4 debt types

- Multiple APR portions

- Avalanche + waterfall

- What-if scenarios

- CSV export

- iCloud backup

- Free updates forever

Compare: Other debt apps charge $12-109/year. PayClear pays for itself in under 7 months vs. the cheapest competitor.

Your financial data stays yours

We built PayClear because you shouldn't have to give a company access to your bank account just to understand your own debt. We literally cannot see your data.

100% Local Storage

All data stored on your device only. Never uploaded to any server.

No Bank Connection

No Plaid. No Finicity. We never connect to your accounts. Period.

No Account Required

No email, no signup, no profile. Just download and start using.

Works Completely Offline

No internet required. Full functionality without any connection.

How PayClear is different

Other apps force you to simplify your debt to fit their model. PayClear handles the complexity you actually have.

| PayClear | YNAB | Debt Payoff Planner | Undebt.it | |

|---|---|---|---|---|

| Multiple APRs per card | ||||

| Fee-based payment plans | ||||

| Promo rate deadline alerts | ||||

| Waterfall visualization | ||||

| Works offline | ||||

| Data stays on device | ||||

| Annual cost | $14.99 total | $109/year | $24/year | $12/year |

* Competitors require cloud accounts and store your financial data on their servers.

Common questions

Why manual entry instead of connecting to my bank?

Three reasons: privacy, reliability, and awareness. Bank connections through Plaid share your transaction data with third parties. They also break frequently. And research shows manually entering data makes you more aware of your finances.

How accurate are the payoff projections?

Projections are as accurate as the data you provide. PayClear calculates daily periodic rates, applies the avalanche method correctly, and follows Credit CARD Act payment allocation rules. If you enter your balances, APRs, and minimums accurately, the math is precise.

What's the difference between avalanche and snowball?

Avalanche (PayClear's method) targets highest APR first—mathematically optimal, saves the most money. Snowball targets smallest balance first—quicker psychological wins but costs more overall. On $10K debt, avalanche typically saves $300-500+ and finishes 1-2 months earlier.

Can I track multiple APRs on the same card?

Yes! This is PayClear's key differentiator. Add each APR portion as a separate entry—purchases at 22.99%, balance transfer at 0%, cash advance at 24.99%. PayClear tracks them separately and allocates payments correctly per Credit CARD Act rules: minimums to lowest rate, extras to highest rate.

Is there an Android version?

PayClear is currently iOS only. We're focused on making the iOS version exceptional before expanding. Sign up for updates and we'll notify you when Android is available.

What happens to my data if I delete the app?

All data is stored locally on your device. Delete the app, delete your data—it's that simple. If you enable iCloud backup (Pro feature), your data syncs to your personal iCloud and can be restored if you reinstall. We never have access to any of it.

Get early access to PayClear

PayClear is currently in beta. Sign up to be notified when it launches and get exclusive early access.

We'll notify you when PayClear is available. No spam, ever.